How to buy a house

When the time is right to purchase a home, knowing what to expect can help you feel prepared and confident.

You’re buying a new house. Congratulations! Owning a home is a dream for many people, but in 2021, only about 65.8% of U.S. residents have achieved this goal. Home-buying can be a complex process filled with jargon and unexpected challenges. Now is the time to not only celebrate, but to plan ahead for each stage of your move — and beyond. Whether your new house will be your home for the next few years, the next decade or to the end of your life, your homeownership has a life of its own. Here are steps to buying a house and what’s helpful to know at each stage of your homeownership experience.

What are the most important things to look for in a new house?

In 2020, over five million homes were sold in the United States according to the National Association of Realtors. To help find the perfect home, consider what’s most important for your lifestyle, then prioritize your list of requirements. It’s true that location is key. But what’s most important to you: access to a lively community or privacy and quiet? Do you want to walk to work? Drive? Take the train? Or maybe you can work from home. Is convenience to shopping and transit more important than a bigger yard? Do you or will you have kids? Are good schools important now or might they be in the future? Whether or not you plan to expand your family is a key question to ask before you buy.

Moving is expensive and a lot of work, so long-term planning is important. If there are two bedrooms now, will you need to add a third? Is the roof or heating and A/C system new or will it need to be repaired or replaced sometime soon? Try to honestly assess your tolerance for maintenance before you buy a house that’s older, larger or has a lot of property. If you love gardening, that’s great. But do you love mowing the lawn? These are the kinds of questions you should ask yourself in addition to the most basic gut check: if you can picture yourself living there, does it make you happy?

Prepare and think long term

The more you can plan and save in advance, the more options you’ll have for the home you are able to buy. If you can, create a line item in your monthly budget dedicated to saving for a home down payment. Then prioritize debt repayment so you have fewer financial obligations and a good credit score, which could save you thousands of dollars over time.

How much will your down and monthly payments be?

As you add to the down payment savings you’ve started, keep the 20% guideline in mind — that’s the total down payment toward your purchase price that enables you to get a mortgage without the monthly expense of private mortgage insurance (PMI).

As you determine how much to save for a down payment, consider what price point you can afford for your house. Mortgage lenders may use the 28/36 rule. This rule states that 28% of your gross monthly income should be the maximum spent on total housing expenses and that not more than 36% should be spent on your total debt (housing, car loans, etc.). Another commonly used and more conservative guideline recommends that your housing payment (including insurance and taxes) should not be more than 25% of your take-home income.

And don’t forget that owning a home includes other costs such as homeowners insurance, property taxes, Homeowners Association (HOA) dues, maintenance, repair and upgrades you might make to a home.

Are you pre-approved for a mortgage?

The pre-approval process includes running a credit check, a review of your income and employment history, debt-to-income ratio and your liabilities and assets. The outcome of this information will determine whether or not you can be pre-approved.

Getting pre-approved might not be a bad idea since it could help the home buying process move along much faster. Being pre-approved shows sellers that you are a serious buyer and could give you an advantage over other buyers. Most pre-approval letters are valid for 60 to 90 days.

Steps to buying a house

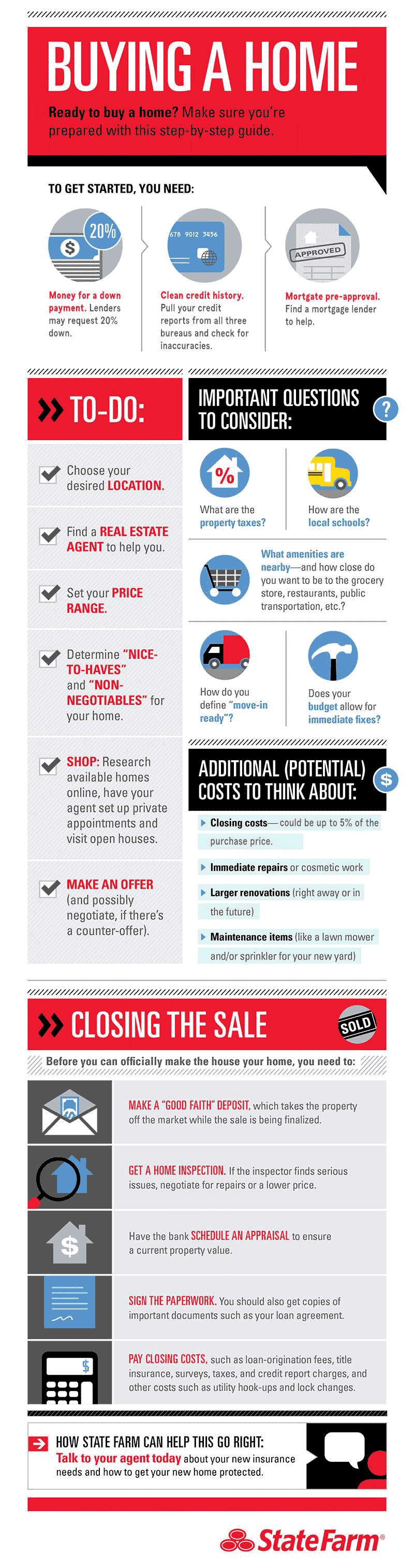

Here are some general steps involved when buying a home:

Preparing

Like with most big life decisions, it's easier both financially and emotionally if you prepare beforehand. Even if you don't expect to buy for a few years, now is the time to get your budget and credit in good shape. You can request a free copy of your credit report from all three bureaus once a year, so try to take advantage of this offering to check for inaccuracies. When you are ready to buy, a good credit score could save you thousands of dollars over time.

House hunting

Think you might be ready to start house hunting? Here are a few tips to get you started:

- Choose your desired location.

- Browse what is on the market.

- Determine “nice-to-haves” and “non-negotiables” for your home.

- Go to open houses.

- If already approved by a mortgage lender, keep your pre-approval letter handy to present to sellers.

- Get recommendations from friends and family for trusted real estate professionals or mortgage lenders that have a history of providing a great experience and who can help you with your house search.

Using the services of a real estate agent or professional shouldn’t cost you, the buyer, unless you engage an exclusive buyer’s agent. Agents are usually compensated from the commission that is paid by the seller. A real estate agent or professional saves you time and helps by:

- Gathering information about the neighborhood that might not be easily available to the public.

- Executing the steps to the home buying process.

- Providing negotiation skills when it’s time to make an offer.

Making the offer

Once you’ve found a house you love, be prepared to quickly make an offer. The offer usually includes a "good faith" deposit, which takes the property off the market while the sale is being finalized. This is where your real estate agent is invaluable and can help you with this whole process. They know the market and may even have insights about the seller and can advise you on making the most attractive offer without over-extending yourself. Here are some things that should probably be done during this next phase.

- A professional contingent inspection is completed — a good idea for both new construction as well as older homes. You might want to attend the inspection and make sure it isn’t rushed. Your inspector is probably the most important member of your team pointing out any unseen defects you might want to negotiate to have fixed. If repairs are needed, you might be able to negotiate a lower price.

- An appraisal of the property is done.

- Your lender should double-check all your information.

And if you are selling your home and buying another, you might want to consider a contingency in your offer. For example, a contingency might be that you must sell your existing home within a certain time frame.

While you’re waiting to close

This is the longest period you’ll have in the house purchase phase until it’s your home. And it’s a good time to slow down before closing. At this point, it’s time to call a State Farm agent to help you select coverage that’s right for you and your new house as your lender will require insurance to be in place before closing. Even if you don’t have a mortgage, insurance is a critical part of protecting your investment from theft, accidents and weather.

You’ll also want to give utility companies your move-in date to establish service — you don’t want to be living in the cold or dark without cable or wi-fi.

Be sure to fill out a change of address form at your local post office or on the USPS website to have your mail forwarded and let key people and institutions (friends, family, employer, bank, credit card companies, etc.) know your new address.

What happens at closing?

Make sure you're ready for all the costs that come with the home closing — no, unfortunately, it's not just the down payment. Closing costs could be up to 5% of the purchase price and might include loan-origination fees, title insurance, survey, taxes and credit report charges. Be sure to ask your lender for definitions and clarity if you see something you don't understand.

On closing day you’ll be all set to sign… and sign… and sign — there can be more paperwork involved than you might imagine. Most often, you’ll get the keys that day or within a few days of closing. The first official stage of homeownership has begun. Like a birth, it’s a beautiful thing.

After the purchase

First things first — change the locks and toss those old keys. If you have time before moving in your furniture and belongings, consider painting and, if necessary, replacing flooring. And there may be other home improvements or do it yourself projects you’ll want to get done.

When the moving truck has pulled away and you’re facing a sea of boxes, start unpacking in the heart of your home: the kitchen. Then move on to the bathrooms, linen closets, bedrooms, common areas (living room, dining room and den) and garage, in that order. Once you’ve settled in, venture out and connect with neighbors and your community. Don’t count on welcome wagons. Be prepared to make the first move by introducing yourself around. As soon as you have the energy, volunteer. It’s a great way to connect and feel at home in your community.

You will also want to make sure you keep certain post-closing documents. These include the purchase agreement, addendums, disclosures and repair requests, escrow information, inspection reports and a closing statement. After you move in, you’ll want to hang on to utility bills, home improvement purchases and receipts, insurance policies and mortgage documents — just to name a few.

Making repairs

Even if your home is brand-new or in perfect condition when you move in, you’ll likely find repairs will become necessary even within the first year or so. Consider getting recommendations for reliable repair companies such as an electrician or plumber.

Seasonal maintenance will be a must and a great way to help prevent major repairs in the future. Be sure to change filters in your air conditioning units or systems, change the rotation of ceiling fans every spring and fall, replace batteries in smoke detectors and carbon monoxide detectors, maintain and add insulation and weather stripping, power wash siding and decking, clean chimneys and heating units and gutters (or have professionals do it). If you’re not handy or motivated to become a DIYer, consider hiring a handyman. Bear in mind that kitchens and bathrooms will likely need to be remodeled, updated, or, at the very least, tiles re-caulked and replaced. Roofing will need to be maintained and repaired every few years and replaced every 12-20 years depending on the type of shingle.

Renovating, remodeling and investing for the future

As your family grows or your lifestyle changes, you may want to add a bedroom or two, a home office, den or playroom, expand your kitchen or add on a porch, sun room or even a sauna. Pools can be a plus in terms of family fun and fitness, but you’ll want to consider the time, energy and money required for annual maintenance above and beyond the cost of installation. If you’re looking to increase the value of your home, make sure your home improvement choices aren’t too quirky or individual. Projects with the best return on investment are generally kitchen and bathroom updates, finished attics and basements, entrances, garage doors, windows and siding.

Reviewing your home insurance

Whether or not you make major changes over the lifetime of your home ownership, your insurance needs will probably change over time. Conducting a home insurance review with a State Farm agent at least once a year can help you determine if your policies and coverage still make sense for your current situation. Ask about discounts for things like alarm systems or having multiple policies. You'll probably want to select a policy amount equal to at least 100% of the estimated replacement cost of your home and its contents. Carefully review the limitations on coverage and exclusions in your policy and consider adding more protection for things like jewelry, fine art, collections, musical equipment, high-end electronics and other particularly valuable items. If you work from home, extra coverages can protect your home office. To make sure you're not overlooking important add-ons to your policy, talk to a State Farm agent about how your life has changed to be sure your policy is keeping up with you, your family and the lifecycle of your home.

This will also be a good time to check your budget to set some goals and create an inventory of everything in your home. A home inventory is a great way to expedite the insurance claims process after theft, damage or other loss. This record of your insurable assets will not only help you in the settlement of a covered loss or claim, but may also help verify tax-deductible property losses and determine the right amount of insurance coverage you need. You can create this inventory using smartphone apps, a video/visual record, a written list or all three. Save receipts and keep them in a safe place outside your home (like a bank safe deposit box).

So much to think about when buying a home! Be sure to educate yourself on common home buying mistakes and know how to avoid them. Happy house hunting!