Hidden costs of buying a home

Even if it's not your first time buying, budget extra and know fees can vary by area.

Saving for a down payment and getting pre-qualified for a mortgage are major financial milestones in the home-buying process. But there are more money-related matters to be aware of during the journey to home ownership.

Prepare yourself by budgeting for the other charges associated with buying a home. And even if you've bought before, be aware that costs may vary by state or region.

Good faith deposit costs

Also known as earnest money, this is a security deposit you'll make to prove your intent to buy the home. This amount is held by the title company. When you purchase the home, the funds are then applied toward the down payment. Though most homebuyers are aware of this payment, what surprises them is that the check usually gets cashed right away. Also, keep in mind that you may not be able to recoup this money if you don't purchase the home.

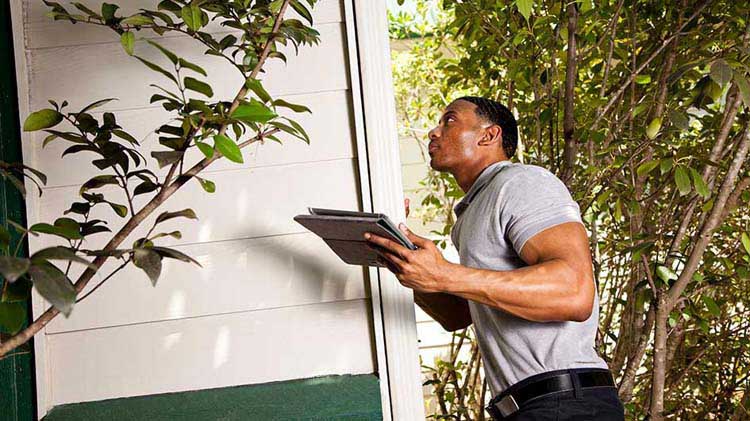

Home inspection costs

You'll learn a lot about the condition of the home you're about to buy with this thorough examination. Independent third-party inspectors give an honest opinion of what repairs might need to be done to the property. Some buyers might think they can save money by looking for the problems with their own eyes and not hiring an inspector. This could be a very costly mistake if problems show up after the purchase.

In addition to a home inspection, you might consider a radon inspection as well as a termite inspection. This list of certified home inspectors can help you find a reputable resource near you.

Down payment costs

The amount you'll need for your down payment will vary depending on the size of home, its location and the type of mortgage you seek. Some lenders may offer loan programs with low down payment options, but may require mortgage insurance, which will increase your total monthly obligation. Discuss your options with your lender.

Closing costs

Closing costs include certain fees involved in the home sale and mortgage transaction. According to Osby, they include, but are not limited to:

- Property appraisal report. Lenders require you to have a professional property appraisal done so they can determine how much money to loan you based on the appraiser's determination of the current market value of the home and mortgage program guidelines.

- Credit report fee,

- Flood certification fee,

- Underwriting fee,

- Title insurance,

- Origination fee,

- Recording fee,

- Application fee (some, but not all lenders charge this),

- Homeowner's insurance premium, and

- Property taxes,

Fees can vary based on location, type of property, mortgage lender and loan product. Your real estate agent and lender can assist with an estimate of fees for your particular situation.

Timeline of payments

You also need to know when you're expected to make these payments. Osby offers this general timeline:

- Good faith deposit: When you make a purchase contract offer on a property.

- Home inspection: Generally, within 10 days of an accepted purchase contract.

- Down payment and closing costs: Should be paid with certified funds at your closing appointment to finalize the transaction.