What is private mortgage insurance?

Depending on your down payment, private mortgage insurance (PMI) may be required. We walk you through PMI basics.

Private mortgage insurance, known as PMI, is generally required if your down payment is less than 20% of the cost of the home. We offer insight into what PMI is, how much it may cost and what you can do to stop paying PMI.

What is PMI?

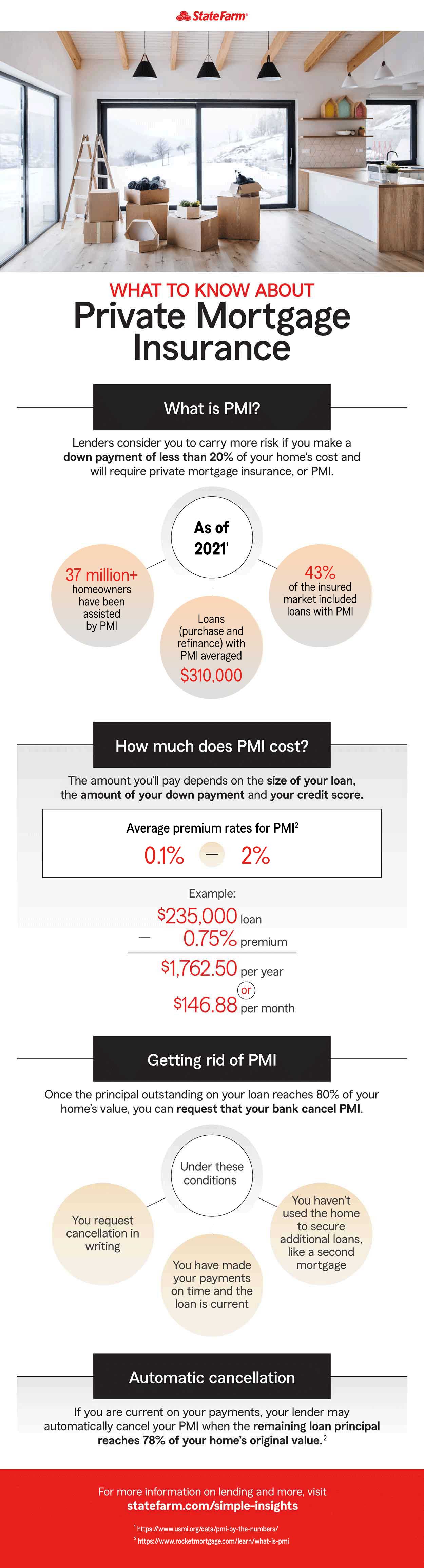

Lenders consider you to carry more risk if you make a down payment of less than 20% of your home's cost. For borrowers with relatively little equity in their home, lenders require private mortgage insurance, or PMI, to protect them if you fail to make payments on your loan.

Average PMI information, as of 2021:

- Over 37 million homeowners have been assisted by PMI.

- The average loan with PMI was around $330,000.

- Over 43% of the insured market included loans with PMI.

Private mortgage insurance vs. homeowners insurance

Often times private mortgage insurance is mistaken for homeowners insurance. PMI assists with securing a mortgage with a down payment of less than 20%, while homeowners insurance helps protect your property when it is damaged in a covered loss.

How much does PMI cost?

If your down payment will be less than 20%, PMI premium payments will likely be part of your monthly loan payment amounts for a while. The amount you'll pay depends on the size of your loan, the amount of your down payment and your credit score. According to Houzeo, average PMI rates typically range from 0.1% to 2% of the loan amount each year.

- Example: $235,000 loan with a 0.75% premium = $1,762.50 per year or an extra $146.88 per month

Getting rid of PMI

Once the outstanding principal on your loan reaches 80% of your home's value, you can request that your bank cancel PMI under these conditions:

- You request cancellation in writing

- You have made your payments on time and the loan is current

- You haven't used the home to secure additional loans, like a second mortgage

Automatic cancellation

If you are current on your payments, your lender may automatically cancel your PMI when the remaining loan principal reaches 78% of your home's original value.

For more information on lending, read about questions to ask your mortgage lender.