First time home owner

Tips and tricks for the first-time homeowner.

Congratulations: You've bought a home! Right now, you're probably feeling excited, happy, nervous and maybe a little overwhelmed.

All of that is natural, of course. But arming yourself with a few must-dos and must-knows can help you happily swing from homeowning newbie to homeowning master in no time. Here's what to consider:

Moving: Get settled

You may be anxious to get started on home improvement — but it's also okay to unpack your boxes and get to know the ins and outs of your rooms and your yard. Take some time to enjoy your new home and prioritize projects once you start to get settled. What spaces do you use the most? As you begin to get organized and think about what your home might look like, ask friends and family what projects they're glad they took on and what they wish they would have done differently. Remember, you've got plenty of time to tackle the to-do list!

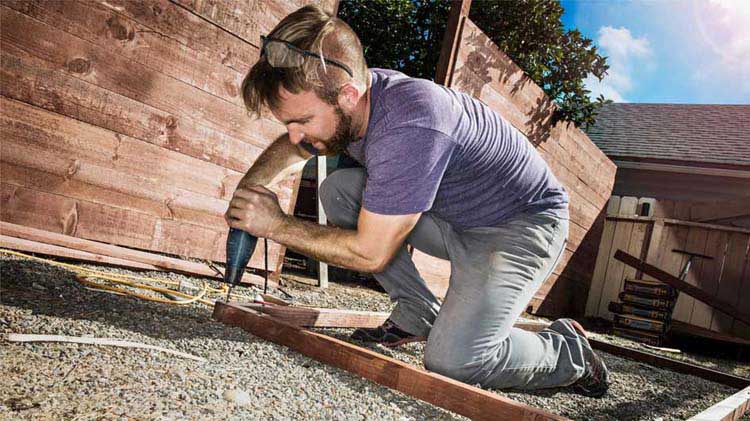

Home improvement: Dream big, start small

Most people have changes, both big and small, that they want to make to a home. Before you do anything, make a master list. It might include big dreams (a kitchen addition!) or even small changes (new hardware for a bathroom). You may also have to-do items from your home inspection that should be added to the list. Although it's easy to feel overwhelmed, it's also important to remember that a home is a long-term investment. Once you have a list, you can prioritize, estimate budgets, start saving and then start doing.

Maintenance: You're in charge

A well-functioning home is like a well-functioning car: It needs regular attention to its operating systems, and occasionally a little tune up. For starters, implement a seasonal inspection routine: Walk around the exterior of your home, then do the same for the interior. Make a list of items that need immediate attention, including dripping faucets and missing downspouts. Add items to your calendar such as "change furnace filter"and "call for fireplace inspection"based on manufacturer or generally accepted recommendations.

Insurance: Inventory your stuff

After purchasing your homeowners insurance, it's a good idea to spend time taking stock of what you own by creating a home inventory. Online options can help, or you can simply photograph each room and record its contents. Once you're done, contact your State Farm® agent to make sure your coverage levels are adequate.

Budget: Plan and save, then plan some more

In addition to budgeting for mortgage, property tax and insurance payments, setting aside funds for both short- and long-term projects, as well as planned and unplanned maintenance, is a good idea. Some estimates place that monthly expenditure at about $1,200 — but it all depends on the size, condition and location of your home. Also consider whether you'll do some maintenance pieces, such as lawn care, yourself; if you do, you'll need to invest in the right equipment, and pay to have that serviced, too.