Uncover commonly missed tax deductions and help maximize your savings

Don't overpay or leave money behind — see that you're taking advantage of all the tax benefits you may be entitled to.

As you prepare for this year's tax season, don't overlook hidden tax deductions that could help minimize your cost and maximize your return. From charitable contributions to retirement savings, let's break down some commonly missed tax deductions to consider.

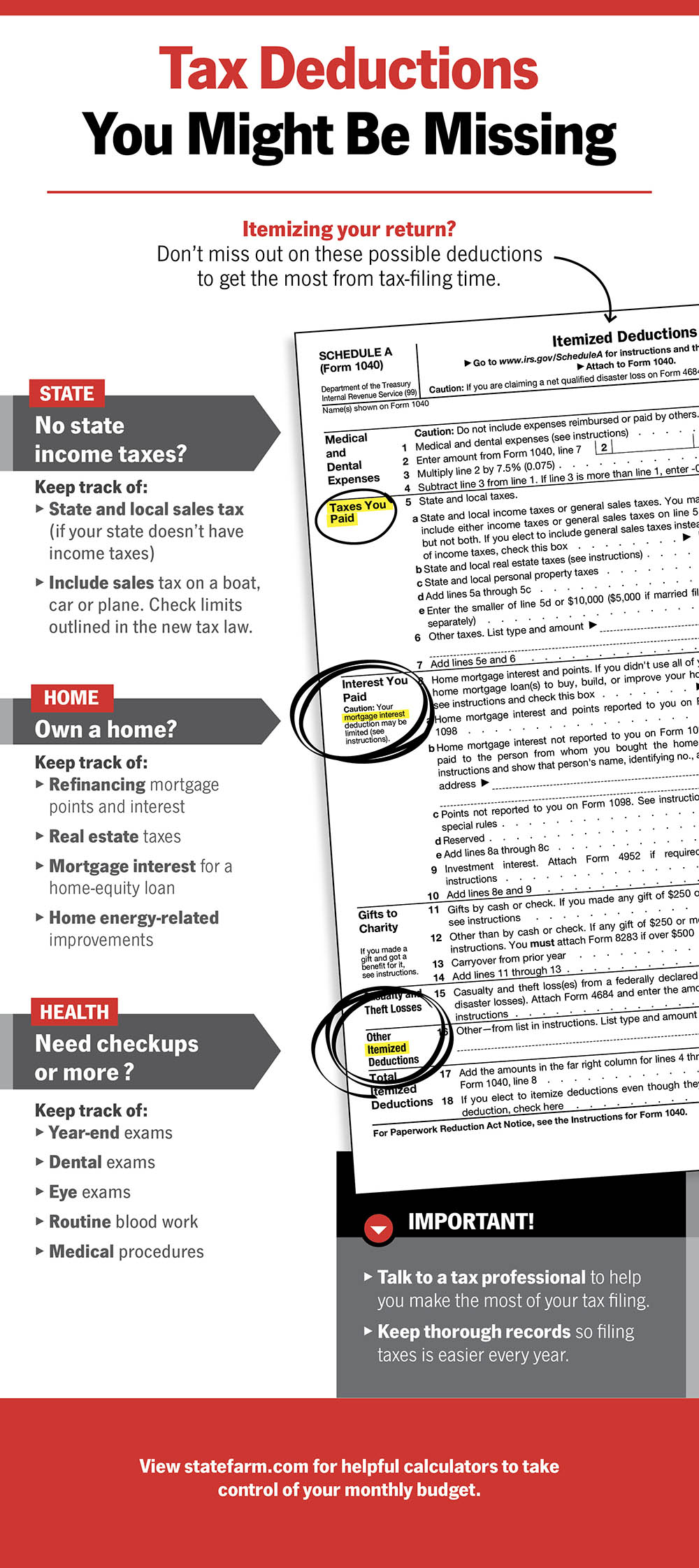

Understanding deductions: Standard vs itemized

After the Tax Cuts and Jobs Act of 2017 (TCJA) was signed into law, the standard deduction increased and continues to do so year after year. When deciding which route to take, consider reviewing the Schedule A form to see if itemizing your deduction is the right option for you.

Standard deduction

When filing your income taxes, choosing between the standard deduction and itemizing can significantly impact your tax liability. In 2024, the standard deduction increased to $14,600 for individuals filing single and $29,200 for married individuals filing jointly. This option is a quick and easy way to help reduce taxable income, but might not always be the most beneficial.

Itemized deduction

Itemizing allows you to deduct specific expenses, which could add up to more than the standard deduction if you track your spending throughout the year. Commonly itemized deductions include mortgage interest, charitable contributions, medical expenses, and state and local taxes. Itemizing can be worthwhile, particularly if you have substantial deductible expenses.

State income tax deductions

If you decided to itemize, you could deduct the state income taxes paid in the prior year. This includes amounts withheld from your paychecks, quarterly estimated tax payments and any payments made when filing your state income tax return. Not all states collect state income taxes. If your state does require it, be sure to keep track of:

- State income taxes paid (if you live in a state where this applies)

- State and local sales tax paid (if your state doesn't have income taxes)

- Sales tax on a boat, car or plane paid during the tax year. Check limits outlined in the new tax law

Tax deductions for homeowners

Mortgage interest can be a major tax write-off for you. As of 2024, you can deduct the interest you pay on up to $750,000 of mortgage debt. Additionally, property taxes are deductible up to a combined total of $10,000 for all state and local taxes, including income or sales taxes. If you own a property or home, keep track of:

- Refinancing mortgage points and interest paid

- Real estate taxes paid

- Mortgage interest for a home-equity loan paid

- Home energy-related improvement amounts paid

Medical deductions

Medical expenses are often overlooked, but can offer significant deductions for those with substantial healthcare costs. To qualify, your total medical expenses must exceed 7.5% of your adjusted gross income. Many health-related and medical expenses are deductible. Deductible expenses can include:

- Year-end exams

- Dental exams

- Eye exams

- Routine blood work

- Medical procedures

- Long-term care insurance premiums

- Travel for medical care (bus fares, parking fees and mileage on your vehicle)

Charitable donations

You might donate money to your church regularly or do a one-time donation to a charity here and there. Consider tracking them to be included on your tax return. The IRS has a guide to help you understand what organizations and donation types may be tax deductible. Some of the donations to consider are:

- Money donated to a church or a charitable organization

- Property given to charities (obtaining a copy of the receipt is recommended)

- Fuel costs when driving for the charitable organization (keep a mileage log for your vehicle, you can track $0.14 per mile)

- Out-of-pocket expenses incurred while helping (items, ingredients or supplies purchased for the nonprofit organization)

Retirement contributions

Contributing to your retirement accounts, regardless if you have a 401(k) plan or an IRA, will lower your overall taxable income. Even though you will end up paying taxes when you withdraw the money in the future, for now, those will make your taxable income smaller than if you didn’t contribute to any retirement accounts. Usually, retirement contributions are made with pre-tax dollars. If that is the case, you may not even need to itemize them on your tax return.

Self-employment expenses

For those who are self-employed, whether it be as a freelancer or completing a small side job, there are many business expenses that you may be able to deduct, including:

- Business cell phone and internet bills

- Advertising materials and office supplies needed to run your business

- Mileage expenses and business travel costs

- Professional fees like legal and accounting services

Tax credits

Tax credits differ from tax deductions, and may also help you at tax time by reducing the amount of taxes owed. Some of the known tax credits to keep in mind are:

- Child Tax Credit — helps families with the cost of raising children. For 2024, it provides up to $2,000 per qualifying child, with the refundable portion limited to $1,700.

- Earned Income Tax Credit — a benefit for low-to-moderate-income earners. The amount varies by income, filing status and number of children.

- Child and Dependent Care Credit — you can claim up to a maximum of $3,000 for one qualifying individual or $6,000 for two or more, allowing for a credit of 20% to 35% of your allowable expenses depending on your income.

- American Opportunity Credit — helps with the first four years of post-secondary education expenses, such as tuition, books and equipment. The maximum annual credit is $2,500 per student. If the credit brings your tax owed to zero, 40% of any remaining amount of the credit (up to $1,000) may be refundable.

- Saver’s Credit — also known as the retirement savings contributions credit, the saver's credit is designed to encourage lower and moderate-income workers to save for retirement. You may qualify for a credit of up to $1,000 ($2,000 if filing jointly) if you make eligible contributions to an IRA or employer-sponsored retirement plan.

Important things to remember at tax time

Whether you decide to complete your taxes on your own or hire a professional, keep thorough records so filing taxes can be easy every year. As you clean out old paperwork, some documents should be saved, others may be shredded. It's important to keep what's truly needed. If you ever have tax questions, consult a tax professional.

Consider these calculators to help you plan and take control of your budget.