Times to review your insurance

During key life moments, make sure you, your family, home, car and property are protected.

Review insurance policies when:

Your current insurance policies are about to expire

If your home, auto, life or health insurance policies are about to expire, make time to meet with your agent. As your needs change, so should your coverage. Your agent can help you review what you want to protect and what you may need.

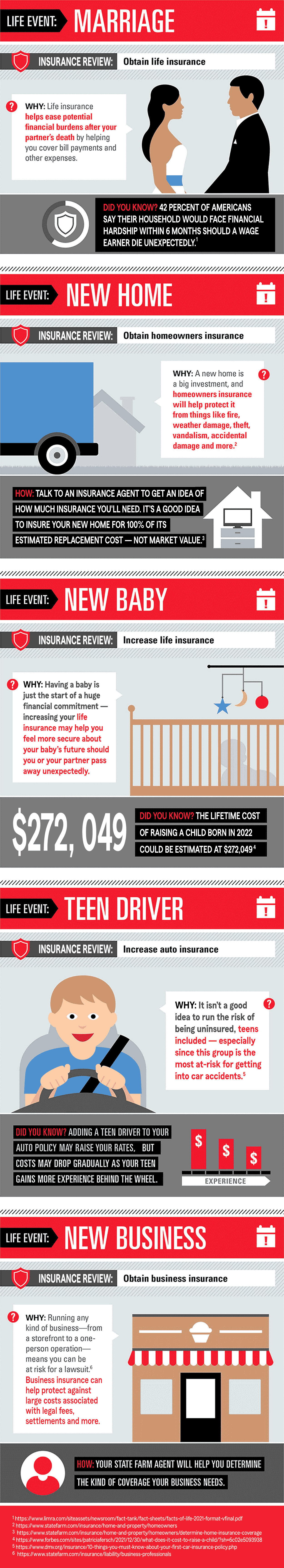

Your family status changes

Planning a wedding, expecting a baby or adopting a child? You'll want to help protect your growing family with adequate life insurance and disability income insurance. Losing a family member through death or divorce also should prompt a policy review. Remember to review and change the beneficiary designations on your existing policies, as needed.

Your children have matured to driving age

When you have a new teen driver, adequate auto insurance is a must. Your agent can perform a car insurance review and look at options with you. Whether your child is leaving for college, or has recently graduated, it's time to consider renters insurance. Personal property and liability protection are typically provided under renters insurance. Discuss with an agent the amount of coverage needed to help protect your child's new home.

You move or remodel your house

When you make upgrades, the replacement cost of your house will likely increase. If you move and downsize your home, you may be over-insured. If you move into a larger home, you may be under-insured. In all three instances, you may want to contact your agent for a home insurance review to help ensure you're sufficiently protected.

You're starting a business

Whether you're renting office space or opening a home-based business, include a thorough insurance review in your start-up plans. Depending on your operation's size, you may have to consider property and liability insurance as well as commercial vehicle insurance. If you have employees, you may also need workers' compensation coverage and a healthcare plan. If you're working from home, review your homeowners plan to see that your business and equipment have coverage.

Your employment status changes

In today's rapidly changing healthcare environment, protecting your family's health can be a challenge. Here are three examples:

- Your current healthcare plan is up for renewal.

- You've started a new job.

- You've been downsized and need brand-new coverage.

In each instance, it's important to take the time to compare plan features against your family's current or anticipated needs. Also, consider disability insurance to help protect against disabling illnesses and accidents.

You've decided to retire

In prepping to retire, make sure you know how your employer handles health insurance coverage once you're Medicare eligible. For out-of-pocket costs not covered by Medicare, supplemental coverage may help.

These are just a few times when you'll want to review your insurance policy. Schedule a conversation today with your State Farm® agent about customizing your coverage and keeping your insurance up to date.