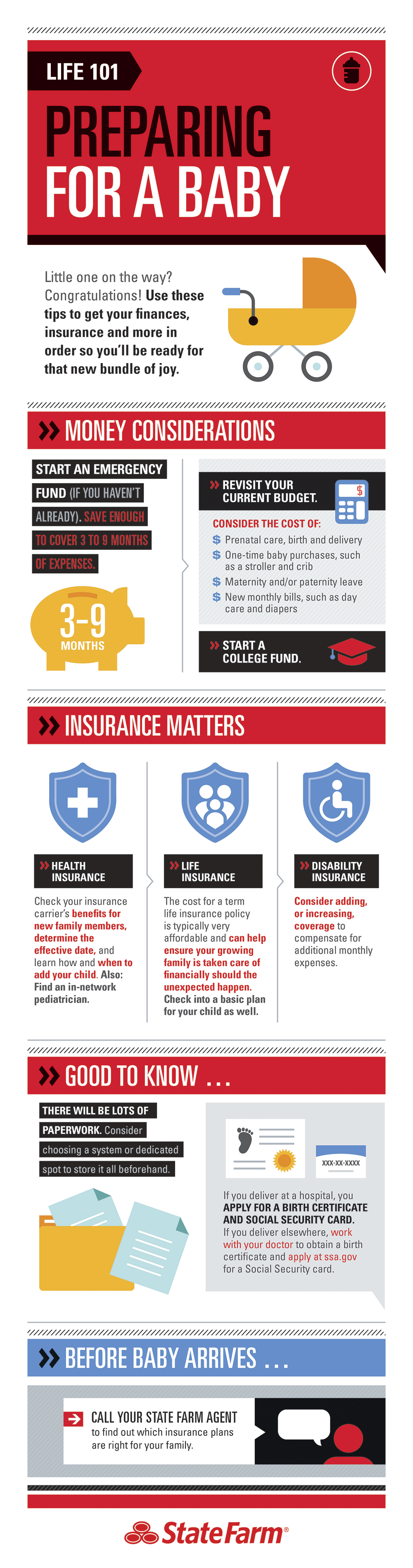

Preparing for a baby

Put these to-dos on your list to get ready for a baby.

Little one on the way? Congratulations! Use these tips when preparing for baby.

Money considerations

Start or add to your emergency fund. It's important to think about the extra costs of raising children, and to adjust your monthly spending and saving. By putting away money — even if it's just $20 here and there — in a bank account for unexpected events, you'll be better prepared when those events arise. Try to save enough to cover 3- to 6-months of expenses, or even 9 months if you can.

Review your existing budget and consider the following costs:

- Prenatal care, birth and delivery

- One-time baby purchases, such as a stroller and crib

- Maternity and/or paternity leave

- New monthly bills, such as day care and diapers

Once you compare your monthly income and expenses, you'll be able to identify and allocate any extra money to your new expenses or emergency fund. It's best to have a savings goal every month and try to stick to it.

Start a college fund. It's never too early to start thinking about your child's future. After addressing the priorities above, speak to a professional to see what plans fit your needs and if it's a possibility for your family.

What baby paperwork to expect

Expect a lot of paperwork. Having an organized file folder or binder will be handy when you need to reference a document at a moment's notice. And remember to pack it in your hospital bag.

Generally, the hospital will have you complete the birth registration form and also apply for your baby's Social Security number. If your baby is not delivered in the hospital, your doctor can help with obtaining a birth certificate, and you can apply for the Social Security card in-person at your local social security office or at ssa.gov.

Insurance matters

Health insurance — Contact your insurance provider to verify benefits and the timeline for adding baby to your plan. You don't want to miss the deadline, otherwise, you may have to wait until the next open enrollment period. This is a good time to review your beneficiaries as well.

You'll also want to start researching and find an in-network pediatrician.

Life insurance — Consider getting life insurance coverage if you don't already have a policy. A term life insurance policy is usually affordable and can help ensure financial security for your growing family should the unexpected happen. Basic plans are available for your child as well.

Disability insurance — Review your plan, and look into adding or increasing coverage to compensate for additional monthly expenses.

Contact a State Farm® agent to find out which insurance plans are right for your family.